Is a New Era of Growth on the Horizon for Latin America?

Download the WEA commentaries issue ›

By Stefanie Garry and Juan Carlos Moreno-Brid

BREAKING THE CYCLE OF LOW, SLOW GROWTH IN LATIN AMERICA?

After a lost decade of turbulent politics, economic turmoil and social unrest in the 1980s, Latin America entered into a period of slow, unbalanced growth throughout the 1990s. However, in the early 2000s, the region appeared to be crossing an important development threshold, poised to break free from the cycle of insufficient expansion that had characterized the previous two decades of economic history, one which created a social structure marred by inequality and economic dualism. Bolstered by dynamic export markets and increased foreign investment, as Ocampo (2009) suggests, prudent fiscal management, low inflation, and stable macroeconomic fundamentals helped to support the notion that Latin America was finally entering a new economic era in the early 2000s, one characterized by steady, high growth.

Various factors contributed to this shift in Latin America’s economic performance, including an improved institutional context buoyed by market reforms (Dabla-Norris, et al,, 2013; Rojas-Suarez, 2009), enhanced trade openness and investment deregulation, as well as technology transfers and the creation of a more modern and competitive business sector (Spillan, Virzi and Garita,2014). Neo-structuralist economists also posit that extraordinary improvements in the terms-of-trade coupled with a re-primarization of the export sector facilitated a rise in consumption without overburdening government finances and external sector accounts (Bertola and Ocampo, 2012; Moreno-Brid, 2015). However, pressing questions remain as to whether or not the region has been able to address important restrictions to sustainable, long-term growth.

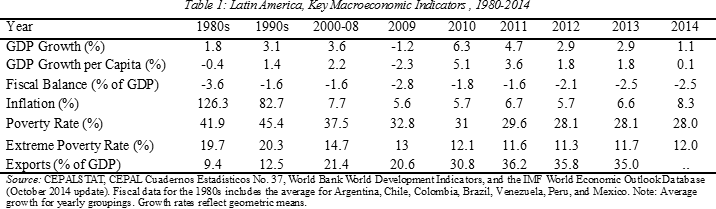

Latin America’s real GDP grew on average 1.8% in the 1980s, climbed to 3.1% in the 1990s and further expanded to 3.6% over the period from 2000-08 (See table 1). Although regional GDP fell by -1.2% in 2009, its contraction was less acute than that of the European Union and the advanced economies as a whole which contracted, 4.2% and 3.5%, respectively (IMF, 2013c). In the wake of the global financial crisis, its quick recovery in 2010 (+6.3%) was further evidence of Latin America’s solid macroeconomic foundations, and perhaps even proof that neoliberal reforms really were beneficial for the region (IMF, 2014; ECLAC, 2013c). Moreover, the recovery in Latin America was supported by the resilience of its financial and banking system and partly by the adoption of counter-cyclical policies including the depreciation of nominal exchange rates, the reduction of interest rates, and the expansion of public expenditure.1 However, since 2011 economic activity has slowed. Real GDP rose 2.9% in 2013, just 1.1% in 2014, and is expected to show a slight overall contraction in 2015, mainly due to the negative performance of Venezuela and Brazil.

On a positive note, the region demonstrates many strong macroeconomic fundamentals, and has made substantial gains in the fight against inflation and fiscal indiscipline. For example, the consumer price index dropped from a three-figure digit during years of hyperinflation in many countries in the 1980s, to two digits in the 1990s, to 7.7% in the 2000s, and has posted even lower figures in recent years. Following the downturn in world commodity prices, particularly of petroleum and its derivatives, inflation has been rather well-contained within national targets, with the recent exceptions of Argentina and Venezuela. In turn, and not unrelated, the fiscal deficit has declined from an average of 3.6% of GDP in the 1980s, to less than half in the following two decades. In 2009 it jumped to 2.8%, a combined result of the recession and the compensatory, counter-cyclical policies adopted in response, though it has stabilized around 2.5% of GDP in recent years (Bertola and Ocampo, 2012; Daude, et. al, 2013; De Gregorio, 2013; ECLAC, 2013a). The recent primary fiscal balances have also been healthy across countries, with the exception of Venezuela. However, the diagnosis of Latin America’s fiscal situation changes when the overall fiscal balance is considered. Such contrasting evolution is not new in a region with a history of volatile public finances and very high public debt. Recall that in the 1980s the rise in interest rates in world financial markets combined with the sharp depreciation of national currencies swelled fiscal deficits, while external public debt rose to 75% of GDP, and surpassed 100% of GDP in countries such as Ecuador, Nicaragua, Peru and Bolivia (Bertola and Ocampo, 2012; ECLAC, 2012). When the debt subsided, it was due largely to restructuring agreements and a return to higher levels of production and growth.

The overall success story in Latin America, since the 1990s masks important country-level distinctions, and the fact that a number of Latin American economies have suffered major balance-of-payments or financial crises, such as the Mexican “Tequila Crisis” in 1994-95 or the Argentine “Tango and Corralito Crisis” of the early 2000s. Certainly, improvements in macroeconomic performance have not been the same across sub-regions and individual countries given the heterogeneous nature of production in the region. Differing trade specializations, macroeconomic goals, and the occurrence of external trade shocks and internal political conflicts have helped to define the growth patterns of individual countries.2 As De Gregorio (2013) highlights, institutional factors may also play a critical role in growth management and macroeconomic stabilization. Moreover, many economies have experienced sharp fluctuations across the business cycle. Unfortunately, in some cases government responses have been largely pro-cyclical, negatively influencing long-term growth, as well as investment and productivity indicators.

In South America, the most dynamic economies in the early 2000s and up to the start of the financial crisis were the exporters of metals and minerals (Peru and Chile) and hydrocarbon exporters (including Venezuela, Ecuador and Colombia). The former group’s real GDP expanded at an annual average rate of 4.8%, and the latter’s at 4.5% from 2000-08, supported by a booming foreign demand (ECLAC, 2013c; Céspedes and Velasco, 2012). On average, and up to 2014, the exporters of metals and minerals and of hydrocarbons have shown the greatest resilience in growth, though their dynamism has tapered in light of the downturn in global commodities prices. Central America has also shown more dynamism than the region as a whole, with steady growth of around 4.5% during the 1980s, 90s and in the years leading up to the 2009 recession. Though relatively small economies, these countries have shown macroeconomic resiliency in the years following the crisis, despite more challenging external conditions and slow growth in major trade partners’ economies including the United States and the European Union.

Brazil and Mexico expanded only modestly in the 1990s, while in the years leading up to the global crisis they grew somewhat faster at 3.6% and 2.4%, respectively. Today, Brazil’s strong commercial ties to the Eurozone, the slowdown of its exports to China, and internal battles against corruption cloud its economic outlook. In 2014 Brazil narrowly escaped recession with 0.1% expansion, and given the fall in global oil prices and the emergence of complex political scandals, the outlook for 2015 remains dim. While Mexico has recently embarked on a new wave of neoliberal reforms, in the context of slow public and private investment and a complicated domestic political climate, it has yet to see substantive growth (IMF, 2014; ECLAC, 2013a, 2013b, Moreno-Brid, 2014). Despite efforts to reform the energy, telecommunications, and banking sectors, Mexico expanded just 2.2% in 2014.

It is clear that economic progress without social development is not sustainable, while social development without economic growth is not possible. After a deterioration in social development in the 90s when poverty levels reached more than 45.4% on average, the region began to make progress in the reduction of both poverty and extreme poverty in the early 2000s, though the pace of improvements has stalled post-2009, with poverty levels stabilized at around 28% of the population. Despite the progress of bringing millions out of poverty, Latin America faces an enormous challenge to reduce the deep income inequality that continues in the region. Troublingly, the Gini coefficient from 2008 shows that regional inequality remains above the level seen in 1980.

2. UNDERLYING RISK FACTORS MAY JEOPARDIZE THE ECONOMIES’ RESILIENCY

Notwithstanding evidence of strong macroeconomic performance in the early years of the 21st century, the prevalence of acute and somewhat asymmetric cyclical fluctuations in the growth path of Latin American economies, as well as the high burden of interest payments on public debt, among other factors, remain as important risks to the region’s long term growth. They also may threaten the capacity of the public sector to respond with resiliency in the face of unforeseen political, economic, or financial sector shocks. Given the somewhat fragile state of global economic affairs, marked by low commodity prices, falling trade and uneven if uncertain growth in developed economies, risk factors become even more important to consider. Five main issues raise significant concern for Latin America’s long-term growth and sustainability: the region’s fiscal performance, the balance of payments constraint, the engines of economic expansion, the region’s productivity gap, and finally insufficient catching up in terms of income and per capita GDP growth.

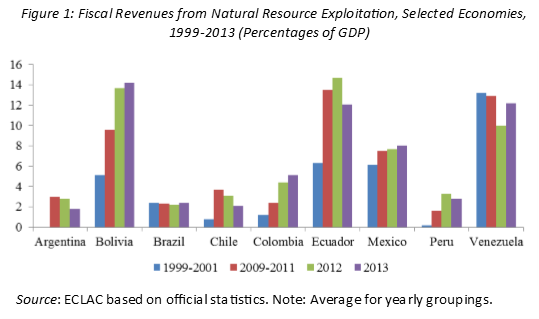

Fiscal Insecurity. In the aftermath of the 2009 financial crisis, it would be difficult to claim that the fiscal performance is the binding constraint on economic growth. Nevertheless, some caveats apply which limit the region’s competitiveness from a fiscal standpoint. Firstly, some countries exhibit levels of tax revenue so low that they are unable to provide adequate public goods such as reliable healthcare, education and security. Secondly, public investment remains markedly inadequate, especially in a region with longstanding needs for infrastructure expansion and upgrading. A third and related issue concerns the dependency of fiscal revenues on commodities exports whose prices can be very sensitive to external shocks. Such dependence limits countries’ capacity to implement counter-cyclical policies in the face of adverse shocks to their terms-of-trade or export revenues (Fricke and Süssmuth, 2014). Indeed, in Mexico, a major petroleum extractor and producer, the amount of revenue from such resource exploitation rose from an already conspicuous 6% of GDP to 7.5% in 2009-11 on average, and grew further in 2013 to 8% of GDP (see Figure 1). As evidenced in late 2014 and early 2015, with the worldwide decline in oil prices, this concern over natural resource dependencies has become particularly pressing.

The balance-of-payments constraint. Latin America’s current account deficit underwent a substantial reduction in the last two decades, going from an average of -2.4% of GDP in the 1990s to -0.3% from 2000-08. It is clear that the commodity boom of 2003-08 and the improvement of the terms-of-trade enabled some countries in the region to grow at a higher pace without putting pressure on their current account balances. In other words, the commodity boom helped these economies temporarily to alleviate the binding grip of the balance-of-payments on their growth. Another factor has been the increasing importance of remittances in the current account balance of many countries. In the current context of volatile exchange rates, and with the imminent rise of US interest rates with the winding down of quantitative easing, a potential net outflow of foreign capital in the future may further underline the relevance of the balance-of-payments as a key constraint for the region’s long-term growth.

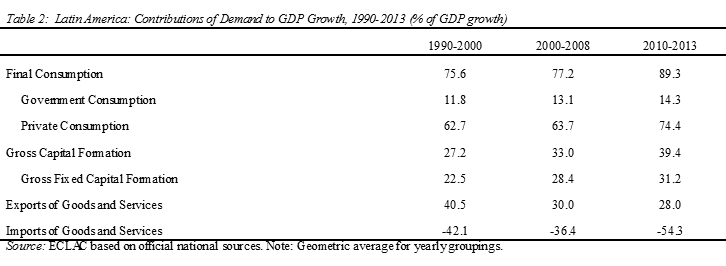

Economic Growth Engines. As Table 2 shows, in the 1990s exports provided a larger contribution to GDP growth (40%) than gross fixed capital formation (22.5%). In 2000-08, perhaps paradoxically, the contribution of exports declined to 30%, while that of gross fixed capital formation rose to 28.4%. This reflects the fact that while exports rose at an average annual rate of 4.5% (7.7% in the 1990s), fixed investment increased at 5.5% (3.8% in the 1990s). Particularly worrying in the post-crisis economic performance of the region is the fact that exports are expanding at a slower pace than the whole economy for the first time in many years, perhaps signaling the end of success of an export-led growth strategy. Clearly, Latin America’s exports will not expand in a much more dynamic way unless they start to diversify to activities based on technologically intensive goods and services. Another feature in the region’s growth performance concerns consumption, which has strengthened notably in recent years. Pre-2009 private consumption contributed around 63% to GDP growth, and government consumption around 12%. In 2010-13 the contribution of private consumption increased 10 points, to an average of 77.4%, and the government’s augmented to 14%. As ECLAC (2013a and 2013b) argues, this shift reflects greater access to consumer credit, somewhat higher real wages and an increase in formal employment in some economies.

Insufficient Productivity. Investment is the key determinant of economic growth and is essential to modernize infrastructure and to expand productive capacities (ECLAC 2012). Troublingly, no Latin American economy has been able to allocate more than 25% of GDP to gross fixed capital formation, the proportion identified by UNCTAD and ECLAC, among others, as the minimum to ensure annual long-term GDP growth above 5%. In other words, the region’s capital accumulation dynamics are insufficient to generate major transformation in its productive capacities (ECLAC, 2013a).The disappointing behavior of labour productivity in the region also has important linkages. Given insufficient investment in infrastructure, machinery and equipment there is no reason why labour productivity should rise to international levels. Across all countries, with the exception of Chile, labour productivity has persistently lagged behind that of the United States. On average the employed labour force in the US is at least four times more productive than its counterpart in Latin America. The worst cases are Bolivia, Paraguay, Peru and Ecuador whose labour productivity is 10 times lower than in the US. Troublingly, the region’s major manufacturing exporters struggle with low and declining levels of labour productivity. By 2013 Mexico’s was not even a quarter of that of the US, while Brazil’s share was less than 15%.

Widening Income Gaps. By examining the evolution of the gap between the GDP per capita of selected Latin American countries and that of the United States, we note that in general, the gap in income is as wide as it was 25 years ago, with Latin American countries reaching per capita incomes of between 25% and 3% of US levels. Chile and Peru are the only countries which have persistently reduced their gap vis-a-vis the United States over the period from 1990-2013. Latin America’s key manufacturing economies also show very disappointing results and weak capacities to transfer the benefits of increased production and manufacturing growth to workers. Mexico’s gap is actually wider in 2013 than it was in 1990, and Brazil has failed to make significant advances. Notwithstanding the region’s renewed dynamism in the 2000s, the region appears to be falling further behind in transferring the benefits of growth and economic expansion to its citizens. Given the sharp disparities in the distribution of income which mark Latin America as the most unequal region in the world, this implies that the living standards of large segments of the population remain low. In order to address these disparities, the region will need sustained periods of high growth over the long term, not just isolated episodes of economic quick recovery.

3. SO WHERE TO NEXT?

In its quest for high economic growth and stable macroeconomic fundamentals, the region is no longer stuck on a long, frustrating and ineffective path, as it was in the 1980s and 1990s. It has made major progress on the macro-stabilization front, lowering inflation, reducing fiscal deficits and penetrating world export markets. Yet, Latin America is far from sustainably changing its development trajectory over the long term. Its growth performance has still, with few exceptions, failed to reduce the income gap vis-à-vis the United States, while weak structural linkages and insufficient investment and innovation hold back the region’s competitiveness. Weak fiscal revenues, the pro-cyclical orientation of fiscal policy and in some cases a dependence on natural resource revenues are important obstacles to improving infrastructure and boosting long-term economic expansion.

After a dynamic recovery in 2010, the region’s economic growth started to taper, dampened by challenging external conditions, as well as a deterioration in the balance of payments. Unfortunately, this subdued growth appears to be the new normality in the region, with just 2.9% expansion in 2013, 1.1% in 2014, and a slight contraction projected for 2015 (OECD-ECLAC-CAF, 2014; ECLAC, 2015). Long-term sustainable growth both for Latin America and its individual economies requires a nuanced understanding of the heterogeneity of productive structures, institutions, labour markets and societal norms. It will be a challenge to continue to decrease the levels of poverty and extreme poverty in the coming years, given current growth prospects. Continuous strong macroeconomic performance, coupled with prioritized social spending is urgently needed to reduce inequality across Latin America. Sustained growth also requires cooperative action from both the public and private sectors to enact reforms and increase productive capacities. Whether the region’s political and economic leaders will be able to do so, thus ushering in a new era of strong, sustained growth in the medium-to long term remains uncertain.

————– REFERENCES

Bárcena, A. and A. Prado (Eds). (2015). Neoestructuralismo y corrientes heterodoxas en América Latina y el Caribe a inicios del siglo XXI. Libros de la CEPAL, N° 132 (LC/G.2633-P), Santiago de Chile, Comisión Económica para América Latina y el Caribe (CEPAL).

Berg, A. J. Ostry and J. Zettelmeyer. (2008). “What Makes Growth Sustained?” IMF Working Paper WP/08/59, Research Department. International Monetary Fund. Washington, DC, United States.

Bernanke, B. S. (2005). “Inflation in Latin America: A New Era?” The Federal Reserve Board. Speech presented at the Stanford Institute for Economic Policy Research Economic Summit, Stanford, CA. United States.

Bértola, L. and J. A. Ocampo. (2012). “Turning Back to the Market.” In The Economic Development of Latin America since Independence. Oxford University Press. Oxford, United Kingdom.

Céspedes, L.F. and A. Velasco. (2012). “Macroeconomic Performance during Commodity Price Booms and Busts”. IMF Economic Review. 60(4). International Monetary Fund. Washington, DC, United States.

Consensus Economics. (2015). Latin American Consensus Forecasts. July 2015 Update.

Dabla-Norris, E. et al. (2013). “Benchmarking Structural Transformation across the World.” IMF Working Paper WP/13/176. International Monetary Fund. Washington, DC, United States.

Daude, C., A. Melguizo, and A. Neut. (2013). “Fiscal Policy in Latin America: Countercyclical and Sustainable at Last?” OECD Development Centre. Working Paper No. 291. Paris, France.

De Gregorio, J. (2013). “Resilience in Latin America: Lessons from Macroeconomic Management and Financial Policies.” IMF Working Paper/13/259.International Monetary Fund. Washington, DC, United States.

Economic Commission for Latin America and the Caribbean (ECLAC). (2015). Proyecciones de América Latina y el Caribe, 2015. http://www.cepal.org/sites/default/files/pr/files/tabla._proyecciones_pib_america_latina_y_el_caribe.pdf.

ECLAC. (2013a). Estudio Económico de América Latina y el Caribe 2013: tres décadas de crecimiento económico desigual e inestable. Santiago, Chile

ECLAC. (2013b). Balance Preliminar de las Economías de América Latina y el Caribe 2013. Santiago, Chile.

ECLAC. (2013c). The Current International Context and Its Macroeconomic Repercussions for Latin America and the Caribbean. Santiago, Chile.

ECLAC. (2012). Structural Change for Equality. San Salvador, El Salvador.

Fricke, H and B. Süssmuth. (2014). “Growth and Volatility of Tax Revenues in Latin America.” World Development. 54: 114–138.

Gutierrez, M. (2005). “Economic Growth in Latin America: The Role of Investment and Other Growth Sources”. Macroeconomía del desarrollo. WP No.6. Santiago, Chile.

Hofman, A. (2001). “Long-run Economic Development in Latin America in a Comparative Perspective: Proximate and Ultimate Causes.” Macroeconomía del desarrollo. WP No.6. Santiago, Chile.

International Monetary Fund (IMF.) (2014).World Economic Outlook Update: Is the Tide Rising? Washington, DC, United States.

IMF. (2013a). World Economic Outlook Update: Growing Pains. Washington, DC, United States.

IMF. (2013b). World Economic and Financial Surveys Regional Economic Outlook. Western Hemisphere: Time to Rebuild Policy Space. Washington DC, United States.

IMF. (2013c). World Economic Outlook Database. Washington DC, United States.

IMF. (2012a). World Economic and Financial Surveys Regional Economic Outlook. Western Hemisphere: Rebuilding Strength and Flexibility. Washington DC, United States.

IMF. (2012b). Statement by the IMF Executive Board on Argentina. Press Release No. 12/30. February 1, 2012. Washington, DC, United States.

Moreno-Brid, J.C. (2015). “Después de la Tormenta: panorama económico de América Latina a cinco años de la crisis financiera internacional”. Foreign Affairs Latinoamérica, ITAM, Vol.15, Nº 2, pp.98-104. México.

Moreno-Brid, J.C. (2014), “Politica macroenomica para el desarrollo”. ECONOMIAUNAM, Vol 32. Mexico, D.F.

Ocampo, J.A. (forthcoming). “Latin America In The Midst Of the Global Quicksands.”

Ocampo, J.A. (2011). “Macroeconomy for Development: Countercyclical Policies and Production

Sector Transformation.” CEPAL Review, No. 104. Santiago, Chile.

Ocampo, J.A. (2009). “The Impact of the Global Financial Crisis on Latin America.” CEPAL Review, No. 97. Santiago, Chile.

Organization for Economic Cooperation and Development (OECD). (2013). Statistics Database. Tax Statistics. Revenue Statistics in Latin America. Comparative Tables. Paris, France.

Organization for Economic Cooperation and Development (OECD) and Economic Commission for Latin America and the Caribbean (ECLAC). (2013). Latin American Economic Outlook 2014: Logistics and Competitiveness for Development. OECD Publishing. Paris, France.

Organization for Economic Cooperation and Development (OECD), Economic Commission for Latin America and the Caribbean (ECLAC) and Banco de Desarrollo de América Latina (CAF) (2014). Perspectivas económicas de América Latina 2015: Educación, Competencias e Innovación para el Desarrollo. OECD Publishing. Paris, France.

Pérez-Caldentey, E., D.Titelman and P. Carvallo. (2014). “Weak Expansions: A Distinctive Feature of the Business Cycle in Latin America and the Caribbean.” World Economic Review. 3:69-89.

Rojas-Suarez, L. (Ed.). (2009). Growing Pains in Latin America: An Economic Growth Framework as applied to Brazil, Colombia, Costa Rica, Mexico and Peru. Center for Global Development. Washington, DC, United States.

Spillan, J, E., N. Virzi and M. Garita. (2014). Doing Business in Latin America: Challenges and Opportunities. Routledge, New York, NY.

_______________________________________________

- In contrast to Greece, Portugal and Spain – the EU economies severely affected by the crisis – Latin American countries could and did respond to the adverse external shock by floating their nominal exchange rates against the dollar in 2009-10 in order to rapidly induce a significant, real depreciation.

- IMF (2013a), Hofman (2001), and Gutierrez (2005) present an analysis of Latin America’s performance from a growth accounting perspective.

Stefanie Garry, Economic Affairs Officer, United Nations Economic Commission for Latin America and the Caribbean (ECLAC) Subregional Headquarters in Mexico, Stefanie.garry@cepal.org

Juan Carlos Moreno-Brid, Facultad de Economía, la Universidad Nacional Autónoma de México (UNAM) juancarlosmorenobrid@gmail.com

For an in-depth analysis of some of these topics see Moreno-Brid and Garry (forthcoming, 2016) “Economic Performance in Latin America in the 2000s: Recession, Recovery, and Resilience?” Oxford Development Studies.

From: pp.2-7 of World Economics Association Newsletter 5(6), December 2015

https://www.worldeconomicsassociation.org/files/Issue5-6.pdf