Birks – Mankiw 7th edn Chapter 3: Interdependence and the Gains from Trade

Mankiw, N. G. (2015). Principles of macroeconomics (7th ed.)

Principles of microeconomics (7th ed.)

Principles of economics (7th ed.)

Mason, OH: South-Western Cengage Learning.

Chapter 3 – Interdependence and the Gains from Trade

When reading the chapter, here are some aspects to consider:

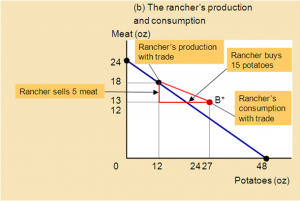

- Note the diagrams in Figure 2 on p.51. We can modify such diagrams to show the pattern of exchange through trade. See the red triangle in the modified diagram below.

This illustrates the move from the production point to the consumption point. In this case the vertical drop indicates the amount of meat sold, while the horizontal line indicates the amount of potatoes purchased. The ratio, or the slope of the line, indicates the price ratio or the rate of exchange between meat and potatoes.

- With a straight line production possibility frontier, there is a constant “rate of transformation” between meat and potatoes. The amount of one that you have to give up for a unit of the other is constant, irrespective of the position on the frontier. It is given by the slope of the line. If through trade a point can be reached outside the production possibility frontier, then the trading partner is offering a more favourable rate of exchange/transformation than can be achieved without trade.

- The last sentence in Section 3.2d on p.54 states, “Trade can benefit everyone in society because it allows people to specialize in activities in which they have a comparative advantage”. This result is based on the specific model, where gains are based on consumption patterns and people are better off if they can consume more. It does not consider whether production patterns might affect wellbeing. Note the following quote from Adam Smith’s famous Wealth of Nations:

“In the progress of the division of labour, the employment of the far greater part of those who live by labour, that is, of the great body of the people, comes to be confined to a few very simple operations, frequently to one or two. But the understandings of the greater part of men are necessarily formed by their ordinary employments. The man whose whole life is spent in performing a few simple operations, of which the effects are perhaps always the same, or very nearly the same, has no occasion to exert his understanding or to exercise his invention in finding out expedients for removing difficulties which never occur. He naturally loses, therefore, the habit of such exertion, and generally becomes as stupid and ignorant as it is possible for a human creature to become. The torpor of his mind renders him not only incapable of relishing or bearing a part in any rational conversation, but of conceiving any generous, noble, or tender sentiment, and consequently of forming any just judgment concerning many even of the ordinary duties of private life. Of the great and extensive interests of his country he is altogether incapable of judging, and unless very particular pains have been taken to render him otherwise, he is equally incapable of defending his country in war. The uniformity of his stationary life naturally corrupts the courage of his mind, and makes him regard with abhorrence the irregular, uncertain, and adventurous life of a soldier. It corrupts even the activity of his body, and renders him incapable of exerting his strength with vigour and perseverance in any other employment than that to which he has been bred. His dexterity at his own particular trade seems, in this manner, to be acquired at the expense of his intellectual, social, and martial virtues. But in every improved and civilized society this is the state into which the labouring poor, that is, the great body of the people, must necessarily fall, unless government takes some pains to prevent it.” From Book V Chapter 1 of Smith, A. An Inquiry Into the Nature and Causes of the Wealth of Nations.

- Even if only consumption is considered, trade may not benefit everyone in society. In addition to relative prices having to be in the right range, you might also wish to consider:

- Adjustment issues – are there costs and delays in adjusting from say a no-trade to a trade pattern production/specialisation?

- While a country may be better off after adjusting fully to a new trade relationship, how are the costs and benefits spread among the population? Consider the phenomenon called the “Dutch disease” (defined here and described in more detail here). Rapid growth in one sector (as from the discovery and exploitation of oil or gas reserves) can push up the exchange rate, thereby harming other sectors.

- The text focuses on comparative advantage, which is presented with given (fixed) production possibilities. This assumption may not apply in the real world. In fact, patterns of comparative advantage are changing all the time. It may be possible to have policies which generate favourable changes for a country. This has been recognised for a long time, although introductory economics texts may not cover this point. Theories of comparative advantage tend to consider prevailing endowments. Another perspective is described in the following quote. It is taken from p.737 of Eatwell (1987). The writer, Ojimi, was at the Japanese Ministry of International Trade and Industry (MITI):

“After the war, Japan’s first exports consisted of such things as toys or other miscellaneous merchandise and low-quality textile products. Should Japan have entrusted its future, according to the theory of comparative advantage, to these industries characterized by intensive use of labour? That would perhaps be rational advice for a country with a small population of 5 or 10 million. But Japan has a large population. If the Japanese economy had adopted the simple doctrine of free trade and had chosen to specialise in this kind of industry, it would almost permanently have been unable to break away from the Asian pattern of stagnation and poverty …

The Ministry of International Trade and Industry decided to establish in Japan industries which require intensive employment of capital and technology, industries that in consideration of comparative cost should be the most inappropriate for Japan, industries such as steel, oil refining, petro-chemicals, automobiles, industrial machinery of all sorts, and electronics, including electronic computers. From a short-run, static viewpoint, encouragement of such industries would seem to be in conflict with economic rationalism. But from a long-range viewpoint, these are precisely in industries where income elasticity of demand is high, technological progress is rapid, and labour productivity rises fast … (Ojimi, 1970).”

Michael Porter gained publicity for promoting the concept of competitive advantage (Porter, 2004). This term refers to the possibility that comparative advantage is not predetermined, but can be changed, as occurred in Japan. Porter placed particular emphasis on the role of competition in this process, hence his name for the concept. Focus on competition through investment, technological change and innovation is not new. A similar point was made by Schumpeter (1976) in his concept of creative destruction. These concepts are based on a more dynamic representation of the issues, as compared to the static analysis used to describe comparative advantage.

- In section 3.3a, readers are asked if Tom Brady should mow his own lawn. It is assumed that he should choose the option giving the higher income. In reality there may not be earning options available at the relevant times. Even if they are, it may not be very enjoyable to spend all the time earning money, and the activity of mowing a lawn may give more pleasure. In other words, the problem is framed in an oversimplified way. We should not just look to see if a posed question has been correctly answered. We should also ask if the right question has been asked.

Eatwell, J. (1987). Import substitution and export-led growth. In J. Eatwell, M. Milgate, & P. Newman (Eds.), The New Palgrave: a dictionary of economics (Vol. 2, pp. 737-738). London: Macmillan.

Ojimi, V. (1970). Japan’s industrialisation strategy. In OECD (Ed.), Japanese Industrial Policy. Paris: OECD.

Porter, M. E. (2004). Competitive advantage: creating and sustaining superior performance (New ed.). New York: Free.

Schumpeter, J. A. (1976). Capitalism, socialism, and democracy (5th ed.). London: Allen and Unwin.

Commentary by Stuart Birks, 28 August 2014, last updated 9 February 2015.