Models and measurement in economics 4—consumption

Download the WEA commentaries issue ›

This piece benefited from remarks by Dian Coyle and Josh Mason

Introduction.

This is the fourth piece in a series which investigates the large and sometimes fundamental differences between macro-economic concepts as used by economic statisticians in the national accounts and as used by (neoclassical) macro-modelers in the so called DSGE (dynamic stochastic general equilibrium) models. The first three pieces (here, here and here) were an introduction, a general overview of the accounts and a piece about the concept of capital. This piece is about the concept of the most important expenditure category of the national accounts and the DSGE models: consumption. I will investigate the different concepts which are used to define ‘consumption’, paying especial attention to the question whether public goods and services are included and to the question whether consumption is about acquiring goods and services or about using them.

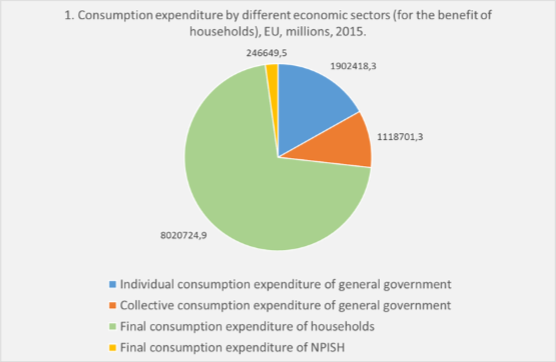

- What is consumption? The national accounts have a well-defined and estimated concept of consumption which encompasses purchases by households but also includes public goods provided by the government to households as well as by ‘NPISH’ (Non Profit Institutions Serving Households, like unions and churches). By doing this the national accounts extend the concept of consumption beyond market exchange and into the realm of gift exchange as well as ‘tax exchange’. DSGE models follow another track. Public goods and NPISH are excluded from household consumption and only market exchange is taken into account. This difference is remarkable. The inclusion of public goods within the consumption boundary has a long history in economics and can be traced back to at least Adam Smith (Smith, 1776). Smith did not call it ‘consumption’ but in the Wealth of Nations the entire fifth and last part of the book is devoted to the necessity of public goods and services and, with a sterling emphasis on evolving institutions, the changing and growing importance of what nowadays is called ‘government consumption’ (i.e. household use of goods and services purchased or produced and distributed by the government). Graph 1 shows that at present both ‘individual government consumption’ (education!) as well as ‘collective government expenditure’ (building and maintaining roads!) are non-trivial.

So, why the difference between the statistics and the models?

I do not have a satisfying answer to this question. Since the days of Smith the realm of household but also of government consumption has greatly increased. Nowadays we use sewer systems, health care has changed beyond recognition, motorized ships, trains, bicycles, cars and planes have, together with a total rebuilding of our roads and canals and other transport systems, totally revolutionized the way we travel, and education has become compulsory and largely a government service. Next to this, the economic concept of consumption has widened too, as is often stated in economic textbooks. After the ‘marginal revolution’ in economics in the nineteenth century work considered unproductive by Smith, like personal services, is considered productive and therewith by definition also included in our definition of consumption. The Eurostat database even contains data on the turnover and price level of prostitution (COICOP code cp 122). But – less often stated in textbooks – the economic concept of consumption, or at least the neoclassical one, became more restrictive, too. Unlike Smith, Alfred Marshall, one of the marginalist economists, included personal services in his concept of consumption, but also unlike Smith he excluded individual and collective consumption expenditure by the government (Marshall, 1890), an exclusion which still is a characteristic of the modern ‘marginalist’ DSGE models. This despite the classic (7900 google citations!) 1954 Samuelson article which (without mentioning Smith but with a profound use of the metaphor of ‘the invisible hand’) introduced the Smithian concept of public provision of goods and services into neoclassical economics (Samuelson 1954). It is important to note that Samuelson, a cunning writer if ever there was one, explicitly used and connected the phrases ‘public expenditure’ and ‘collective consumption’.1 But though ‘public expenditure’ is included in the DSGE models it is, ignoring the work of Samuelson, not supposed to add to ‘utility’ and is therewith considered to be wasteful by definition (see for instance formula 55 and 56 of a paper which elaborates the benchmark DSGE model of the ECB, Bokan e.a. (2016)). Aside of this, DSGE models also exclude consumption of goods and services provided by NPISH. - The DSGE concept of consumption not only excludes government provision of goods and services, it also only recognizes market transactions and has a fundamental forward looking, intertemporal character.2 The totally forward looking character is related to the reformulation of General Equilibrium by Arrow and Debreu to include all transactions until the end of time (really…), as, in the parlance of DSGE models, ‘the models look at a complete set of Arrow-Debreu commodities’, including, to push this point, an apple bought in Rome in 2023. A trade-off between present and future transactions is obtained by the interest rate or, one should state, ‘an’ interest rate as it is not entirely clear to me which interest rate households are supposed to use (the classical formulation of this is Samuelson (1937) who was however quite critical of this idea). Goods and services in these models are generally non-durable, which means that there is no stock of durable goods like cars – the model is in the end about purchasing goods and services, not about using them. Bokan e.a. (2016) however introduce a housing sector (houses are the durable good par excellence) which rents houses to households. As the models only recognize market transactions and do not recognize non-market production of housing services by households living in their own house this is the only way they can model this. Bokan e.a. do not include the price and volume estimates of housing services of the national accounts – or any other estimate of this whatsoever – into their model.

- A forthright consequence of treating government consumption as wasteful by definition is that using DSGE models to gauge, for instance, the consequences of cuts to the provision of public goods in Greece will not show any decline of ‘utility’ in the models, noting also that, in the models, ‘unemployment is leisure’ which means that unemployment actually increases ‘utility’. In contrast, using national accounts to map the consequences of such a decline of government expenditure will show a decline of production and employment, a post World War II record decline of minus 25%, as it happened. This is along with a matching increase of unemployment and (not measured by the accounts) misery and (measured by the accounts) a decline in for instance medical services. Concepts of production, prosperity and consumption as well as the choice of the consumption boundaries do matter! Remarkably, the assumed wasteful nature of government spending is not a necessary element of the models. DSGE models with non-wasteful government spending are possible, as indicated by the title of a 2012 working paper by Yasuhara Iwate, ‘Non-wasteful government spending in an open economy estimated DSGE model: two fiscal policy puzzles revisited’ (Iwata 2012). For the geeks: one can either include government consumption directly into the utility function or use the concept of Edgeworth complementarity, i.e. the idea that a car is useless without (public) roads. But such DSGE articles are black swans. To return to the questions posed above (why the differences between the statistics and the models): we can at least state that excluding government consumption from the models is, considering Smith (1796), Samuelson (1954) and Iwate (2012), a conscious, rational choice and not a unavoidable necessity. And a choice which is pretty convenient for economists who defend brutal austerity.

- There are not just differences between the statistics and the models. A common aspect of both of them is that they are transaction based. Consumption, as defined in the national accounts, is a monetary flow concept based upon a restricted period of time. It is not about the use of goods but about acquiring goods and services. There are also notable imputations of non-monetary, non-market transactions like imputed rent of owner occupied dwellings as well as the imputation of ‘Fisim’, which tries to divide net interest paid by households into a fee for financial services and ‘pure’ interest. See Coyle, 2014, for a brief and not very affectionate investigation of this last concept. These imputations are not without consequences for understanding the national accounts. Recently, the ONS has stripped national accounts household income from all kinds of imputations to estimate a monetary concept which is closer to the actual experience of monetary income by households (Curtis, Davies and Weston, 2016). This stricter monetary concept of income, which better matches income in all kinds of income surveys and is closer to the experience of households, showed in 2008-2009 a much stronger increase in the monetary savings rate of households than the national accounts concept. This means that the crisis was for a much larger part caused by balance sheet effects than indicated by the national accounts income concept. As far as I’m concerned, this totally underscores the need for monetary macro-economic variables which do not estimate welfare or prosperity but the circular flow of monetary expenditure, income and production.3

- Restricting consumption to acquiring instead of using goods is questionable. Purchasing potatoes is not the same thing as cooking and eating homemade Belgian fries (a recipe here), buying a Dacia Logan is not the same thing as driving it. A convincing case can be made that to estimate welfare or prosperity an estimate of real consumption, like driving your car and eating homemade meals is more important than an estimate of the acquisition of goods and services. But we’re living in a monetary world. And, as explained in the second of these posts, national accounts do not try to estimate prosperity but try to estimate the circular flow of monetary income, expenditure and production. The Greek example however clearly shows that a clear relation between (changes in) these flows and (changes in) prosperity exists. Which is one reason why, guided by the ideas and person of John Maynard Keynes and against the background of high unemployment during the Great Depression and the war effort of World War II, much emphasis was placed upon the difference between present monetary flows and their maximum. This is an emphasis which, considering contemporary discussions about the level of potential income, never disappeared. Despite this, it is clear that at any given moment the stock of cars and roads is more important to consumers than the flow of new cars and the building of new roads. An analysis of this surely worthwhile and economists should probably pay more attention to this. This is however not what the national accounts intend to estimate – these were established to estimate the circular monetary flows of production, income and expenditure (and have been extended to include information about assets, debts, employment and money as well as granular data on sub-sectoral flows).

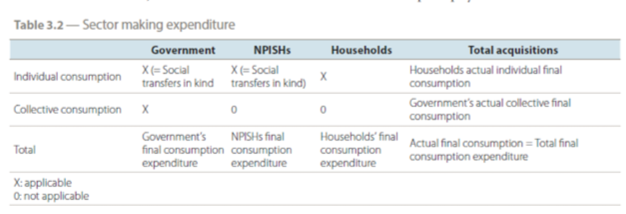

- In the text above, I deliberately often used the phrase ‘acquiring goods and services’. The flow of national accounts consumption is not just about the purchase of goods and services by households. As the ESA 2010 states: “final consumption expenditure consists of expenditure incurred by resident institutional units on goods or services that are used for the direct satisfaction of individual needs or wants or the collective needs of members of the community … actual final consumption consists of the goods or services that are acquired by resident institutional units for the direct satisfaction of human needs, whether individual or collective. Below, a snapshot from table 3.2 from the ESA 2010 explains this definition in a little more detail, note that actual final consumption is considered to be consumption by households, of services like education but also of defense. Some might not see this last kind of consumption as ‘optimizing utility’. But that’s not the point. Households do pay for it and therewith do consume it, by definition.

To give an idea of the granular nature of the national accounts it is useful to give some detail about the national accounts definition of government consumption (ESA 2010):

“Alternatively, individual consumption expenditure of general government corresponds to division 14 of the classification of individual consumption by purpose (Coicop), which includes the following groups:

14.1 Housing (equivalent to COFOG group 10.6)

14.2 Health (equivalent to COFOG groups 7.1 to 7.4)

14.3 Recreation and culture (equivalent to COFOG groups 8.1 and 8.2)

14.4 Education (equivalent to COFOG groups 9.1 to 9.6)

14.5 Social protection (equivalent to COFOG groups 10.1 to 10.5 and group 10.7).

3.106 Collective consumption expenditure is the remainder of the government final consumption expenditure.

It consists of the following COFOG groups:

(a) general public services (division 1);

(b) defence (division 2);

(c) public order and safety (division 3);

(d) economic affairs (division 4);

(e) environmental protection (division 5);

(f) housing and community amenities (division 6);

(g) general administration, regulation, dissemination of general information and statistics (all divisions);

(h) research and development (all divisions).”

Household purchases are defined and estimated in an even more granular way. Consumption includes some but not all household production for own use. A clear example is production from vegetable gardens (insignificant in rich countries but crucial in some African ones) and imputed rents for owner occupied dwellings. Unpaid housework is excluded. If possible, equivalent market rental prices are used to value the service of owner occupied houses (kept clean and comfy by unpaid household labor). Considering the existence of a market alternative (renting a house) a case can be made to do this. There are however reasons why people do not use the market alternative and a case can also be made that a production costs or a ‘hedonic’ alternative should be used..

Summarizing: the accounts have a broad, detailed, well defined and estimated and backward looking monetary flow concept of consumption which includes non-market transactions. The DSGE models use a restricted, non-empirical and totally forward looking concept of consumption which only looks at market transactions. Neither the accounts nor the models look at the use of (durable) consumer goods. The accounts might however be a good idea to keep the use of all kind of imputations to the accounts as limited as possible and to show purely monetary income and expenditure next to concepts of income an expenditure which include all kind of non-monetary production.

Literature

Bokan, Nikola, Andrea Gerali, Sandra Gomes, Pascal Jacquinot and Massimiliano Pisani (2016). ‘EAGLE-FLI. A macroeconomic model of banking and financial interdependence in the euro area’, European Central Bank working paper series no. 1923. Available here.

Coyle, Diana (2014). GDP: a brief but affectionate history. Princeton, Princeton university press.

Eurostat/European Commission (2013). European system of accounts ESA 2010, available here.

Marshall, Alfred (1890). Principles of economics. An introductory volume. MacMillan and Co: London. Online version available here.

Samuelson, Paul (1937). ‘A note on the measurement of utility’ in The Review of economic studies 4(2):155-161.

Samuelson, Paul (1954). ‘The pure theory of public expenditure’ in The Review of Economics and Statistics 36(4): 387-389.

Knibbe, Merijn (2007). ‘De hoofdelijke beschikbaarheid van voedsel en de levensstandaard in Nederland, 1807-1913’ in Tijdschrift voor Sociale en Economische Geschiedenis 4(4):71-107.

Sekera, June (2016). The public economy in crisis. A call for a new public economics. Heidelberg: Springer.

Smith, Adam (1776). An inquiry into the nature and causes of the wealth of nations. Methuen & co.: London. Online version of the fifth edition, available here.

Davies, Phillip, Nicola Curtis and Luke Weston, ‘Alternative Measures of Real Households Disposable Income and the Saving Ratio: June 2016’. Available here.

________________________________________________

- See Sekera, 2016, for a criticism of the rational, neoclassical nature of Samuelson’s consumer of public goods.

- Samuelson was well aware that including public consumption into neoclassical economics also required a widening of the scope of transactions beyond market transactions, considering the last sentence of his 1954 article: “Political economy (i.e. market oriented neoclassical economics, M.K.) can be regarded as one special sector of this general domain (i.e. all transactions, M.K.), and it may turn out to be pure luck that within the general domain there happened to be a subsector with the “simple” properties of traditional economics”.

- Which does not mean that non-monetary variables are not important. See Knibbe, 2007, for an estimate of per capita availability of food in the Netherlands, 1807-1950.

From: p.p.4-7 of World Economics Association Newsletter 6(5), October 2016

https://www.worldeconomicsassociation.org/files/Issue6-5.pdf

This is very interesting view. I think other way: Need more discussion on “productive consumption” rather than only “consumption”. Productive consumption is a part of consumption. How do we identify “productive consumption” and “consumption”? Conceptual clarity provides intuition and reasonable sense of measurement. We should identify circulatory and non-circulatory variables for consumption and development issues; target specific economic agents in micro level, meso-level and finally in macro level.

Measurement is not the issue if the concept is clear about the measurable variable (with universal proper definition).

The discussion might benefit from a legal distinction between different kinds of legal right: production rights vs consumption rights, which parallels the distinction between civil property and commercial property. Such distinctions are adopted in the so-called “Legal Analysis of Economic Policy” (LAEP) approach. See: https://www.researchgate.net/publication/280977715_New_Legal_Approaches_to_Policy_Reform_in_Brazil