Knibb – Measuring capital

Merijn Knibb illustrates the problems of aggregation when he writes:

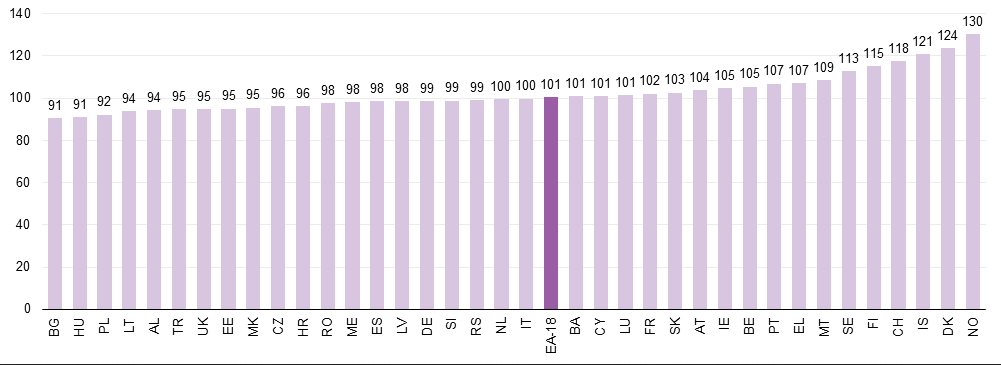

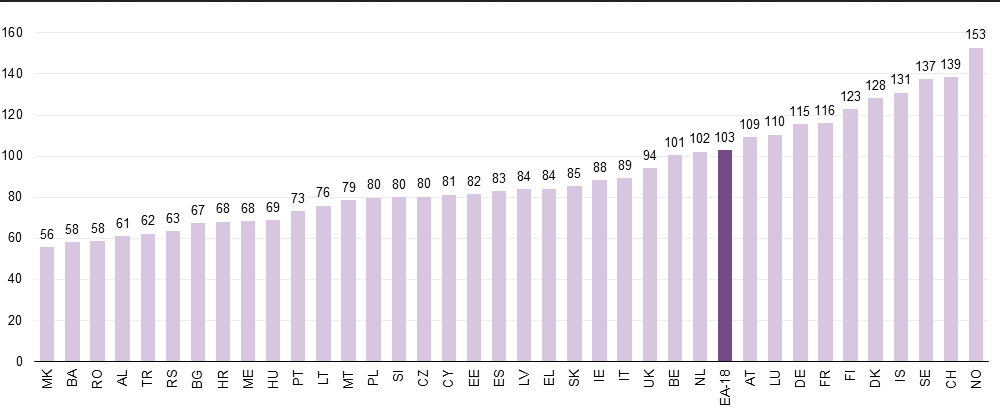

International price differences of ‘machinery and equipment’ are remarkably small within the EU. International price differences of another kind of fixed assets, residential building and civil engineering works, are remarkably large (see graphs).

Investments in ‘machinery and equipment’ as well as new ‘residential buildings and civil engineering works’ (i.e. construction) are both future oriented. The flow of expenditure on both kinds of investments can be compared, using the GDP-grid. Both kinds of investment boost our stock of ‘fixed assets’ and both are in a sense a ‘sunk cost’ transfer of the present generation to future generations. But can we arithmetically compare the stock of total ‘machinery’-capital with the stock of total ‘construction’-capital? In an economic sense, the stock of ‘machinery and equipment’ is a quite different item than ‘Residential buildings en engineering works’:

Graph 1. Price level indices for machinery and equipment, 2013, EU-28=100

Graph 2. Price level indices for construction 2013, EU-28=100 Eurostat

Machinery is internationally tradeable, the production process is characterized by international supply chains, costs are only to a very limited extent based upon ‘land’, it is mainly used by profit oriented companies and it deteriorates quite fast.Residential buildings and civil engineering works are not internationally tradeable (or even not tradable at all), the production process is characterized by mainly national supply chains, costs are decisively influenced by the price of land and are mainly used and/or owned by households and governments, which contrary to companies do not try to earn a monetary profit.

All these differences makes it rather complicated to lump both kinds of assets together into one kind of productive ‘capital’ in a macroeconomic supply function, as economists often do. Can we really add the resale value of a plane with the book value of a bridge? And how to evaluate the large but fickle ‘land rent’ component in the price of buildings with the international supply chain based price of machinery? The large international difference in investment prices suggests that aggregating problems are non-trivial.

Commentary added, 13 December 2014