Hill – Mankiw 9th Edn Chapter 13 – Costs of Production

Mankiw, N. G. (2021) Principles of microeconomics (9th ed.)

Principles of economics (9th ed.)

Mason, OH: South-Western Cengage Learning.

Rod Hill

University of New Brunswick, Saint John campus

Saint John, New Brunswick, Canada

email: rhill@unb.ca

Chapter 13 – Costs of Production

Here are some things to consider when reading this chapter. We can first consider what’s in the chapter before briefly mentioning some things that are not discussed. Many of these points, as well as others, are discussed in detail in Chapter 5 of Hill and Myatt (2022).

- The goal of the firm: profit maximization?

Mankiw tells the story of an imaginary firm, Chloe’s Cookie Factory. Most firms in the real economy are proprietorships or partnerships, so this story of a firm owned and run by an entrepreneur is relevant.

To describe or to predict a firm’s behaviour, we need to know the objective/objectives of the owner/owners. Economics typically assumes that people make choices to maximize their well-being or utility. Why not apply this to the choices made by Chloe, the business owner here? Her utility could depend on profits, but also on other things such as maintaining a healthy work-life balance. As Emily Northrop also points out, “profit might be willingly sacrificed to provide more generous wages and benefits for employees, to allow production processes that are more environmentally sustainable, or to provide monetary or in-kind support for community charities” (2013, p. 113).

That the owners’ utility is always maximized solely by maximizing profit is not very plausible. Is the assumption more applicable to the large corporations that dominate many sectors of the economy? After all, they are run by managers, supervised by a Board of Directors who are supposed to see that management acts in shareholders’ interests. Shareholders may want profits maximized.

This is an example of the principal-agent problem, which Mankiw describes in Chapter 22 (p. 449). Here, shareholders are principals who attempt to get their agents, the Board members, to act in their interests. In turn, the Board members are principals who may try to get their agents, the firm’s managers, to make profit-maximizing decisions.

However, if stock in the company is widely held, individual shareholders may free ride, hoping that other shareholders monitor the Board of Directors. Board members may have their own interests, including being reappointed to the Board, something for which the corporation’s CEO may have considerable influence. In turn, senior managers may have their own interests, including excessively high salaries and stock option packages (e.g. see Bebchuk and Fried 2004). It would be surprising if profit maximizing behaviour regularly occurred in this setting.

Emily Northrop (2013, p. 114) points out that the assumption of profit maximization originated with the 19th century French economist Augustin Cournot, who pioneered the application of calculus in economics. The assumption was useful for the mathematics and wasn’t based on observations about how firms actually behaved. The introductory textbooks maintain this convenient assumption using words and diagrams in place of the calculus which awaits students in subsequent theory courses.

- What are alternatives to the assumption of profit maximization?

In his study of the development of managerial capitalism, The Visible Hand, Alfred Chandler put forth a fundamental proposition that emerged from his research: “in making administrative decisions, career managers preferred policies that favored the long-term stability and growth of their enterprises to those that maximized current profits. For salaried managers, the continuing existence of their enterprises was essential to their lifetime careers.” They could do this because of their relative autonomy in making decisions given that the “stockholders did not have the influence, knowledge, experience, or commitment” to take part in the management of the firm (1977, p. 10).

The idea of assuring the survival of the firm is also a feature of the post-Keynesian theory of the firm. In an environment of fundamental uncertainty, where the outcome of actions today cannot be known even probabilistically, the firm’s management tries to reduce the risks it faces. It can do this by trying to acquire power over the economic, political and social environment in which it operates. The growth of the firm also improves its long-term chances of survival. While profits contribute to growth by funding investment and facilitating access to credit, management is willing to sacrifice some profit to achieve greater growth (Lavoie 2014, pp. 128-47).

- What is the evidence for profit maximization?

Mankiw asserts (p. 244): “Economists… find that this assumption [of profit maximization] works well in most cases”, but offers no explanation of how this conclusion is reached and gives no references to any empirical studies. Surveys of managers yield a variety of responses about their objectives: profit maximization, attempting to attain a target rate of return, maintaining the firm’s market share, among others (Blinder et al. 1998, pp. 40-44). As the previous section indicated, there are good reasons to think that managers have other objectives than attempting profit maximization. Once the technical details of profit maximization have been described in Chapter 15, the Commentary for that chapter will briefly describe some further evidence that suggests that the typical firm does not maximize profits.

- What might firms’ production functions and costs actually look like?

Mankiw’s account of production in the short run features diminishing marginal product for the variable input in the short run. Diseconomies of scale eventually occur in production in the long run. Given the prices of inputs, such as raw materials, wages and the cost of capital equipment, over which the firm is assumed to have no influence, these production relationships lead, in Mankiw’s words, to “some lessons about costs that apply to all firms” (p. 243, my emphasis). These result in “typical cost curves” for “a typical firm” (p. 254).

Mankiw: “According to the law of supply, firms are willing to produce and sell a greater quantity of a good when the price of the good is higher.” The cost curves described in this chapter “will give you a better understanding of the decisions behind the supply curve” (p. 243). What constrains a firm’s production is rising marginal costs, not limited demand for its product.

However, the short-run and the long-run U-shaped average costs described by Mankiw (and every other standard text) are not based on evidence about firms’ actual costs. They are concocted to allow upward sloping supply curves to exist. Both the claims of diminishing marginal returns in the short run and diseconomies of scale in the long run are contradicted by the evidence. Acknowledging this would leave no place for the supply and demand/perfectly competitive market model that is examined in the next chapter – the central model used throughout the text.

(i) What is the evidence about short run costs?

Allan Blinder and co-authors surveyed executives from a sample of 200 American firms with annual sales of more than $10 million (Blinder et al. 1999). One question involved marginal costs. 11 percent of respondents reported increasing marginal costs; 40 percent said marginal costs were decreasing as the range of output increased, while 49 percent said marginal costs were constant. The authors concluded that this “paint[s] an image of the cost structure of the typical firm that is very different from the one immortalized in the textbooks” (1999, p. 105).

This is not surprising. It is consistent with empirical studies of costs going back decades (Lavoie 2014, p. 151). How marginal costs behave depends on the specific situation, as the example of the next section will show. The standard texts’ portrayal of a universal account of costs that applies to all firms cannot be correct.

(ii) Production in the short run without diminishing marginal returns

Mankiw’s account of production does not distinguish clearly between the stock of factors available (the number of workers, the number of machines, for example) and the flow of services that those factors provide (e.g. labour services per hour, machine hours). Production is a flow of output per unit time produced by a flow of input services and flows of material inputs, such as raw materials and energy.

In the case of the cookie factory, the flow of output (cookies per hour) in the short run seems to be produced by varying the stock of one of the factors (the number of workers employed) while the stock of capital – the plant and equipment to make cookies – is fixed (pp. 247-9). Mankiw writes: in the short run, “Chloe can vary the quantity of cookies produced only by changing the number of workers she employs” (p. 247). A student could easily get the impression that at each rate of production the capital input is the entire stock of capital, not the hourly services of the capital equipment that is being employed. The story of the diminishing marginal product appears to result from additional workers producing less and less additional output while working with a fixed capital stock.

Mankiw defines marginal product as “the increase in output that arises from an additional unit of input” (p. 248). In this definition he does not specify “the quantity of all other resources employed remaining constant” (a phrase taken from the definition in McConnell at al. 2021, p. 145, and a qualification that is made explicit in most other textbooks). Keeping this in mind, let’s consider his next example of production.

The story of the diminishing marginal product of labour in the short run in Caleb’s coffee shop involves expanding output by using both more workers and more capital inputs: “When Caleb produces a small quantity of coffee, he has few workers, and much of his equipment is not used.” Because there is excess capacity, an extra worker “can easily put these idle resources to use” producing a lot of extra coffee, so its marginal cost is low (p. 253).

While the story is inconsistent with the marginal product of labour definition, which requires that all other inputs be held constant, the inconsistency is necessary if any additional output is going to be produced. An additional hour of work time without any additional inputs (and hour of espresso machine time, additional coffee beans, milk, electricity, and so on) would produce nothing. Instead, Mankiw is telling a story of short run production in which there is ultimately a capacity constraint.

The amount of extra coffee that an additional worker can produce with the equipment depends on how worker time and equipment time can be combined. If the production process were described clearly as flows of services of labour and of capital equipment and of other inputs together producing flows of output, it is easy to imagine how diminishing marginal product could be postponed until production reached the maximum possible level that the coffee shop could produce.

For example, in many production processes, labour and capital services are used in fixed proportions (Miller 2000; 2001). Consider an hour’s worth of services from each of: one bus and one bus driver, one professor and one classroom, or (as in Caleb’s coffee shop) one espresso machine and one barista to operate it. In such cases, factors of production are complements: increasing the services of any one of the inputs alone will produce no additional output.

To produce more coffee, an additional worker hour must be combined with an extra hour of espresso machine time. The marginal product of each worker-hour and espresso machine-hour bundle is constant as is the cost of producing an additional cup of coffee. This could continue until all of Caleb’s equipment is being fully employed. Then the shop’s capacity to produce coffee has been reached.

The example could easily be made more realistic by recognizing that additional tasks are needed in the coffee shop. Workers need to be relieved during breaks, customers’ orders taken, tables cleared, coffee cups washed, and so on. As more coffee is produced using additional espresso machine hours, the need for such work-time increases proportionately. Suppose, for example, that once these tasks are taken into account, additional coffee can be produced using two worker-hours and one espresso machine-hour. Then adding additional worker time would produce no useful services, but would simply add to costs.

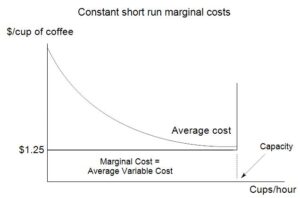

In this case, the marginal cost curve would take the shape of a laterally inverted L, as shown in the figure. Average costs would be decreasing, as shown, because average fixed costs decline while average variable costs remain constant.

Instead, in Mankiw’s account just how additional workers work with the equipment is left vague: “when Caleb produces a large quantity of coffee, his shop is crowded with workers, and most of his equipment is fully utilized. Caleb can produce more coffee by adding workers, but these new workers have to work in crowded conditions and may have to wait to use the equipment” (p. 253). But if some of the equipment is not fully utilized, an additional hour of work time produces more coffee just like any of the other hours of work time. Once the equipment is fully utilized, an additional worker-hour spent ‘wait[ing] to use the equipment’ produces nothing.

(iii) Diseconomies of scale?

As illustrated in Mankiw’s Figure 6 (p. 256), Average Total Cost rises at high rates of output, illustrating the concept of diseconomies of scale (sometimes called decreasing returns to scale). This implies that long run marginal costs (not illustrated) must also be increasing. Note that the figure refers to “adjusting the size of the factory to the quantity of production” (p. 256, my emphasis). Yet the discussion of diseconomies of scale refers to the size of the firm: “at high levels of production, the benefits of specialization have already been realized, and coordination problems become more severe as the firm grows larger” (p. 257, my emphasis).

Mankiw explains: (257): “Diseconomies of scale can arise because of coordination problems that often occur in large organizations. The more cars Ford produces, the more stretched the management team becomes, and the less effective the managers become at keeping costs down. This analysis shows why long-run average-total-cost curves are often U-shaped” (p, 257, my emphasis). This story, offered without evidence, seems to make sense only if the firm has a single factory, which is clearly not the case with Ford.

Mankiw’s account seems to treat the attention of management as a kind of ‘fixed factor’ (e.g. “the more stretched the management team becomes…”). This seems to use the concept of diminishing marginal returns even in the long run, a period of time when all factors are supposed to be variable. As Avi Cohen points out, this “does not stand up to even casual logical scrutiny, let alone to the empirical evidence on non-increasing costs”. He adds: “Just as there is a range of available techniques of production in the long run, we should expect a range of available techniques of management, including techniques better adapted to large scale enterprise”. He cites writers going back to the 1950s who show that “there is no necessary reason why management cannot efficiently change or adapt to larger scale output” (1983, p. 217).

In his nonstandard text, Peter Dorman explains how this can be done. Corporations that produce a variety of products can construct managerial hierarchies for each product, or for each subsidiary, where managers operate with considerable autonomy. Top management act as planners, making strategic decisions, allocating resources in a general way between one area and another. This “permits corporations to grow as large as they wish without overtaxing their operational management” (2014, pp. 156-7).

(iv) “A scandal”

Herbert Simon, the recipient of the 1978 Nobel Memorial Prize in Economics, once said “I think the textbooks are a scandal…. The most widely used textbooks use the old long-run and short-run cost curves to illustrate the theory of the firm. … I find that inexcusable. … I don’t know of any other science that purports to be talking about real world phenomena, where statements are regularly made that are blatantly contrary to fact” (Simon and Bartel 1986, p. 23).

Why the textbooks cling to this fictitious account of production and costs will be clearer after reading the next chapter on firms in perfectly competitive industries. The perfectly competitive model requires that firms experience costs with these characteristics.

- What’s missing?

Some obvious features of actual business firms and their behaviour are unmentioned or undiscussed.

(i) The political power of business

Mankiw and the authors of all standard texts discuss only costs directly related to the production of goods or services. They almost entirely ignore the power that some firms, particularly large ones, have – and use – to shape their external environment to their advantage. Attempts to shape public policy can be a profitable investment. These are economic decisions just as much as deciding whether to hire more workers or to build a new production facility.

The texts seem to want us to forget what everyone knows: corporate power influences virtually every aspect of public policy, including foreign and military policy, international trade policy, tax policy, environmental regulation, laws about intellectual property (such as patents and copyrights), competition policy, and workplace and product safety regulation. If firms can make investments to change public policy to increase their profits and to exert control over their environment to enhance their chances of survival and prospering, why does the text not acknowledge and discuss this?

(ii) Alternatives to the authoritarian capitalist firm

In Mankiw’s examples, the capitalist entrepreneurs, Chloe, the owner of the cookie factory, and Caleb, the owner of the coffee shop, are the bosses who make all the decisions. But why are capitalists – a word that does not appear in Mankiw’s text – the bosses? Wouldn’t firms behave differently if they were democratic, so that workers or customers owned the firm and elected the management, as in cooperative firms? Although such firms exist, they are missing from Mankiw’s text and, to be fair, have disappeared from other standard texts (Kalmi 2007). The authoritarian capitalist firm is taken for granted and the possibility of alternative democratic forms of organization is ignored.

REFERENCES

Bebchuk, Lucian, and Jesse Fried (2004) Pay without Performance: The Unfulfilled Promise of Executive Compensation, Harvard University Press.

Blinder, Allan, Elie Canetti, David E. Lebow and Jeremy B. Rudd (1998) Asking about Prices: A New Approach to Understanding Price Stickiness, Russell Sage Foundation.

Chandler, Alfred D. (1977) The Visible Hand: The Managerial Revolution in American Business, Harvard University Press.

Cohen, Avi (1983) ‘“The laws of returns under competitive conditions”: Progress in microeconomics since Sraffa (1926)?’, Eastern Economic Journal, 9(3): 213–20.

Dorman, Peter (2014) Microeconomics: A Fresh Start, Springer.

Hill, Rod and Tony Myatt (2022), The Microeconomics Anti-Textbook, Bloomsbury Publishing.

Kalmi, Panu (2007) ‘The disappearance of cooperatives from economics textbooks’, Cambridge Journal of Economics, 31(4): 625–47.

Lavoie, Marc (2014) Post-Keynesian Economics: New Foundations, Edward Elgar.

Miller, Richard (2000) ‘Ten cheaper spades: Production theory and cost curves in the short run’, Journal of Economic Education, 31(2): 119–30.

Miller, Richard (2001) ‘Firms’ cost functions: A reconstruction’, Review of Industrial Organization, 18(2): 183–200.

Northrop, Emily (2013) ‘The accuracy, market ethic, and individual morality surrounding the profit maximization assumption’, The American Economist, 58(2): 111–23.

Simon, Herbert, and Richard Bartel (1986) ‘The failure of armchair economics’, Challenge, 29(5): 18–25.